Automatic for the people

The introduction of the auto-enrolment pension system will be a major regulatory shift. But is it the end of the world as we know it, ask Orla Ormsby and Jane Barrett

Proposals to introduce mandatory pension saving in Ireland have been mooted by various governments over the last two decades or so. Those proposals never quite reached the stage of draft legislation.

So, the Automatic Enrolment Retirement Savings System Act 2024 was a major regulatory shift in the pensions landscape.

The Government has expressed the intention for the first auto-enrolments of employees into the system to begin in January 2025. However, that timeline is not mandated in the act and, as such, is open to change.

Admittedly, previous target start dates for the automatic enrolment (AE) system proposed by Minister for Social Protection Heather Humphreys have been missed. However, the swift progression of the legislation from bill to act, from April to July 2024, shows the commitment of the present Government to introducing these landmark reforms.

Although the act was signed into law on 9 July, action is still required by the minister to bring various provisions of the legislation into force.

Finest worksong

The act sets out the framework for the establishment of a new state body – An tÚdarás Náisiúnta um uathrollú Coigiltis Scoir (National Automatic Enrolment Retirement Savings Authority).

The AE Authority is tasked with establishing, maintaining, and administering auto-enrolment in Ireland. The act requires the authority to appoint investment managers who will provide the investment funds for AE at selected risk levels.

The act does not specify what charges will be levied in AE funds or whether a cap will apply (a maximum annual management charge of 0.5% was envisaged in the March 2022 design principles for the system).

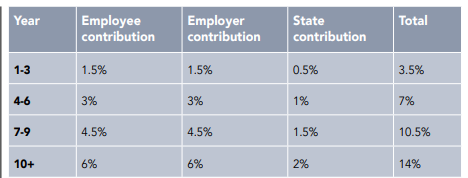

The AE system is designed to operate based on matching mandatory employer and employee contributions, with an additional State contribution.

The rates of contribution are to be phased in over a ten-year period, as set out in the table.

The contributions are to be calculated based on the gross pay of the employee, subject to a maximum earnings threshold of €80,000 per annum. The deduction of employee contributions will be from net salary.

The act does not facilitate the payment of additional voluntary contributions (AVCs).

Shiny happy people

‘Employee’ for AE purposes is quite broadly defined as a person in receipt of ‘emoluments’ (as defined in tax legislation).

We expect this will include employees under contracts of employment, but also potentially extend to individuals such as non-executive directors or persons in receipt of a pension or annuity where payroll taxes are being operated on payments to them.

Employees will be automatically enrolled into the AE system if they fulfil three conditions:

- Are aged between 23 and 60,

- Have a total gross pay from all employments of €20,000 or more, and

- Are not in ‘exempt employment’.

Crucially, ‘exempt employment’ is defined in the act as an employment that can satisfy one of the following two tests:

- The employee contributions test – employee contributions are being deducted via payroll to a ‘qualifying’ pension scheme, trust RAC, personal retirement savings account (PRSA), or a pan-European pension product (PEPP), or

- The employer contributions test – employer contributions are being deducted via payroll to a pension scheme, trust RAC, PRSA or PEPP.

As only one of the two tests needs to be satisfied, it means that if an employee is contributing to a personal pension (PRSA/trust RAC/PEPP) via payroll (without any matching contribution from the employer), they will not be included in the AE system.

This is a softening of approach compared to the general scheme of the Automatic Enrolment Retirement Savings System Bill 2022, which had proposed that both employer and employee contributions to a pension scheme would be required.

Good advices

The act foresees minimum standards being drawn up by the AE Authority related to levels of contributions (and possibly other matters that the AE Authority, in consultation with the Pensions Authority, considers appropriate) to define what will be considered a ‘qualifying’ pension scheme, trust RAC, or PRSA.

These standards must be drawn up by no later than the seventh year of auto-enrolment (when the employer/employee mandatory contribution will be 4.5%). The aim is to ensure that standards for employees in a ‘qualifying’ pension scheme, trust RAC, PRSA, or PEPP are at least as favourable as AE.

Therefore, in due course, pension schemes and PRSAs will have to meet minimum contribution thresholds for employees to continue to be regarded as being in ‘exempt employment’ and outside the scope of the AE system. Until then, any level of contribution will satisfy the respective tests.

It is noteworthy that, after initial publication of the bill, a PEPP was added to the employee and employer contributions test in technical Government updates. However, overseas pension schemes (such as overseas IORPs with a home country in another EU member state) were not specifically included.

What’s the frequency, Kenneth?

The act empowers the sharing of information between Revenue and the AE Authority. Consistent with this, the employee and employer contributions tests are framed by reference to contributions or deductions from salary having been subject to mandatory reporting to the Revenue Commissioners.

The AE Authority will examine information available via Revenue returns to determine what employees should be auto-enrolled.

The act requires the AE Authority to set the following actions in train for in-scope employees:

- Notices of determination (with enrolment dates) will issue to the employer informing them of employees in scope of AE (details of which must be passed to the relevant employees), and

- Payroll notifications will issue to the employer with information on the contributions payable and deductions to be made in respect of employees.

An employer is then required to make the necessary contributions and deduct the correct employee contributions for the pay reference period. Failure to do so will be a statutory offence and, upon conviction, a daily interest rate will be levied on unpaid contributions, for repayment to the AE Authority.

Life and how to live it

As with any mandatory pension system, it is designed with employee inertia in mind. The act requires an employee, once enrolled as a participant in the AE system, to remain in the system for a minimum period of six months after their enrolment.

A window of opportunity to opt-out will arise in months seven and eight after enrolment, or after a phased increase in contribution levels. An employee who opts out is entitled to a refund of their own contributions paid.

The employer and State contributions remain invested in the participant’s account. Opt-outs will be re-enrolled by the AE Authority two years after opting out (provided they still satisfy the conditions).

As an alternative to opting out, a cash-strapped employee can suspend contributions. The opportunity to suspend contributions arises once the first six months has passed (or once six months has passed since an earlier suspension of contributions) and no return of employee contributions arises on a suspension. Suspension is for a maximum of two years.

Certain employees that are not automatically enrolled can decide to ‘opt in’ to the AE system. This opt-in right arises only for employees that are not in ‘exempt employment’ who are aged between 18 and 66. The AE Authority will determine upon application to them whether a right to opt-in arises.

Finally, the act allows participants to take their pension at State pension age – that is, age 66 and no earlier (unless in an exceptional case of ill-health).

The act is only designed to facilitate taking benefits as a lump sum, with secondary legislation expected to introduce alternatives (such as purchase of annuity/pension) in due course. Significantly, the tax treatment of the lump sum on drawdown is not dealt with in the act. This uncertainty is not ideal.

Everybody hurts

An employee may request a review of certain determinations of the AE Authority under the terms of the act, including (for example) that a person satisfies or does not satisfy the conditions for enrolment or opting-in.

The act provides a process for review and appeal of such determinations, with a participant (if unsatisfied) having recourse to the Financial Services and Pensions Ombudsman.

The act also introduces two new offences to protect employees:

- Penalisation of an employee by an employer for attempting to exercise their entitlement to participate in the AE system, and

- A person ‘hindering’ or attempting to ‘hinder’ an employee from participating in AE.

The act provides that employees have recourse to the Workplace Relations Commission where they complain of penalisation or being ‘hindered’. The WRC may direct an employer to facilitate AE for the employee and make the necessary contributions within a prescribed period. The act provides that a maximum of four weeks’ remuneration may also be awarded in the circumstances.

Stand

The introduction of AE in Ireland will likely introduce additional business costs for employers. To prepare for its introduction, employers will need to assess how many of their employees, if any, will fall within the scope of the AE system and budget accordingly.

The considerations and choices for employees will differ depending on their business and any retirement-savings vehicles already offered. Workers on a standard tax rate may well gain more benefit from AE versus those on a marginal tax rate through the tax relief offering in a pension scheme or PRSA.

For workplaces that operate a voluntary defined-contribution scheme, there is a risk of a two-tier system evolving in the same workplace if some employees are members of a defined-contribution (DC) scheme and others are in AE.

From an administrative perspective, this may be challenging for payroll – calculations based on basic pay (common in DC) versus gross pay (AE system) and deductions from gross pay (DC) versus net pay (AE).

Furthermore, depending on the structure of the workplace DC scheme, the AE system might be seen as the poorer alternative (for example, no risk benefits, no opportunity for financial advice, inability to make AVCs, no transfer permitted to other arrangements, and limited early retirement in the AE system). This may risk possible employee relations issues.

As such, employers already operating pension schemes may wish to consider amending the rules of their pension scheme and possibly also the terms and conditions of employees to position all employees as being in ‘exempt employment’ when AE is rolled out.

Employment-law considerations will clearly arise here, but a detailed consideration of employment-law issues is beyond the scope of this article.

Man on the moon

Throughout the act, there are references to an intention for secondary legislation to further regulate various aspects of the AE framework, so we can expect more laws to follow.

The Government has signalled an intention for the AE system to commence in January 2025. This is ambitious, given the scale of work to be completed to get the system off the ground (establishing the AE Authority and appointing investment managers, for a start).

Once rolled out, however, the new AE system and related regulations will be relevant for all practitioners advising employees and employers.

Jane Barrett is a senior associate on the pensions team in William Fry and a member of the Employment and Equality Law Committee Pensions Sub-committee; Orla Ormsby is head of legal (intermediary division) and pensions counsel at Irish Life and chair of the Employment and Equality Law Committee Pensions Sub-committee.